The ABSCoRES project introduces a groundbreaking approach to assess risk in energy generation akin to the credit scoring systems employed in finance and banking. Just as in banking where credit scores help gauge financial risk, ABSCoRES aims to measure and quantify the risk associated with energy generators in the New York Independent System Operator (NYISO).

Recognizing the challenges stemming from imperfect and asymmetric information about energy assets, ABSCoRES pioneers a risk-scoring methodology tailored for stakeholders in the electricity system. Drawing from established risk quantification approaches, the project acknowledges the complexities of assessing information uncertainty distributions affecting participants in energy markets.Unlike traditional methods, ABSCoRES estimates risk scores utilizing data outputs from the Security Constrained Unit Commitment (SCUC) and Security Constrained Economic Dispatch (SCED) optimization modules, coupled with dynamic and physical characteristics of energy generators. This data-driven approach ensures a comprehensive risk evaluation, maximizing accessibility to crucial information for stakeholders.Leveraging state-of-the-art optimization and machine learning techniques, ABSCoRES evaluates the efficiency impacts of increasing variable renewable energy sources (VRES) penetration on all energy generators. Furthermore, the project aims to bridge the information gap by providing a robust risk measurement framework akin to banking standards, facilitating risk assessment and information sharing among users in the electricity system.

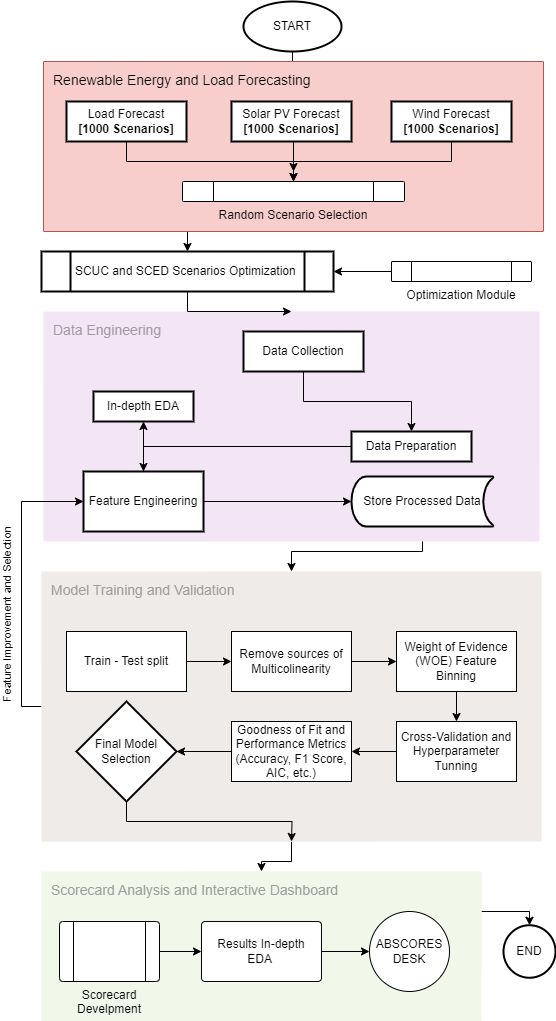

Our Approach

Data Preparation:

- Utilize output and input data from SCUC and SCED optimization models to construct necessary data for machine learning models.

- Include asset performance metrics and relevant characteristics impacting risk performance.

- Apply standard data engineering procedures to ensure data cleanliness, completeness, and representativeness.

- Experiment with lagged and polynomial features to introduce non-linearity.

Model Training:

- Train machine learning models and leverage a streamlined training pipeline

- Utilize cross-validation to prevent overfitting.

Model Evaluation:

- Evaluate model performance using industry-standard performance metrics

- Consider computational times required for model training and other stakeholder constraints.

Scorecard Development:

- Map outputs of the selected model into a credit risk scorecard using ranges typical in US credit scoring.

ABSCoRES Desk Interface:

- Design an interface, the ABSCoRES Desk, as an information terminal for stakeholders.

- Provide stakeholders with data analysis tools and individual/aggregated risk score metrics.

- Enable informed decision-making beyond price signals to mitigate epistemic risks and enhance energy aggregation reliability and efficiency.

Making the Score Operational